Copper’s 5% Weekly Surge Ignites Market

Quick Look

Copper prices rally above $9,000 a ton amid supply cuts, marking a significant shift from months of inertia.

Iron ore prices plunge below $100 a ton for the first time in seven months, reflecting demand headwinds and China’s property crisis.

The contrasting fortunes of these commodities highlight differing market sentiments and economic outlooks.

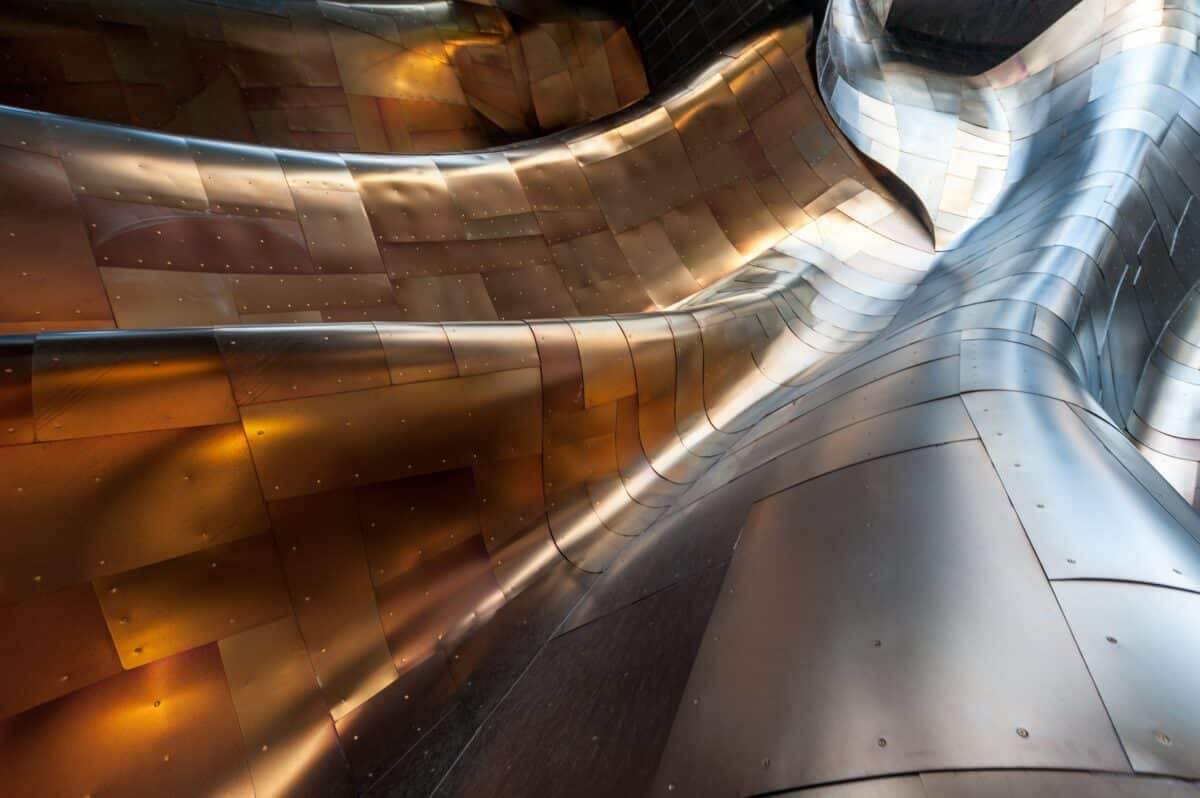

Copper, often regarded as a bellwether for the global economy, has seen its price surge by almost 5% this week, breaking free from a prolonged period of stagnation. This rally, which has pushed prices above the $9,000 mark, comes amid growing concerns over supply disruptions in key mining and smelting operations. Investors and traders are increasingly optimistic, betting that the worst of the global downturn might be behind us. This sentiment is buoyed by the growing demand for copper in burgeoning sectors such as electric vehicles (EVs) and renewable energy, industries that are essential to the green transition.

Iron Ore’s Decline: Lingering Pessimism

In stark contrast, the iron ore market is facing severe headwinds. Prices have fallen below $100 a ton for the first time in seven months. This downturn reflects a broader sentiment of caution among investors. They are increasingly concerned about the lasting impact of China’s property crisis on demand. Since January, the steelmaking ingredient has seen a dramatic 30% price drop. This decline occurs as the anticipated revival in construction activity fails to materialize. Consequently, steel mills are incurring losses, and stockpiles are growing at Chinese ports. Therefore, the outlook for iron ore appears grim. Furthermore, recent announcements from the National People’s Congress in Beijing have exacerbated the situation. They set a modest 5% economic growth target but did not introduce significant measures to boost construction. This lack of action has only added to the bearish sentiment.

Market Watch: Navigating Uncertainties

The diverging trajectories of copper and iron ore prices highlight the complexities and uncertainties in global commodity markets. Copper’s price increase signals optimism, driven by the shift towards a more sustainable and electrified economy. On the other hand, the decline in iron ore prices points to challenges in traditional industries. This is especially true in light of China’s economic slowdown and its global impact. Investors and analysts are keenly watching market shifts, including changes in inventory levels and production adjustments. The next few weeks will be crucial in determining the future of these important commodities.

The differing fortunes of copper and iron ore reflect the global economic situation and indicate changes in the commodity markets. Copper’s success is tied to positive trends, whereas iron ore’s difficulties highlight broader problems. This contrast suggests that investors should be cautious when navigating these uncertain markets.

The post Copper’s 5% Weekly Surge Ignites Market appeared first on FinanceBrokerage.